Welcome

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

I try to add tax blog articles weekly on tax topics that may be interesting to you. Please browse. If there is a topic you would like to see here or would like to more information on, please contact me.

From IRS Tax Court Case Quezada v. IRS, 2020 PTC 382 (5th Cir. 2020) .

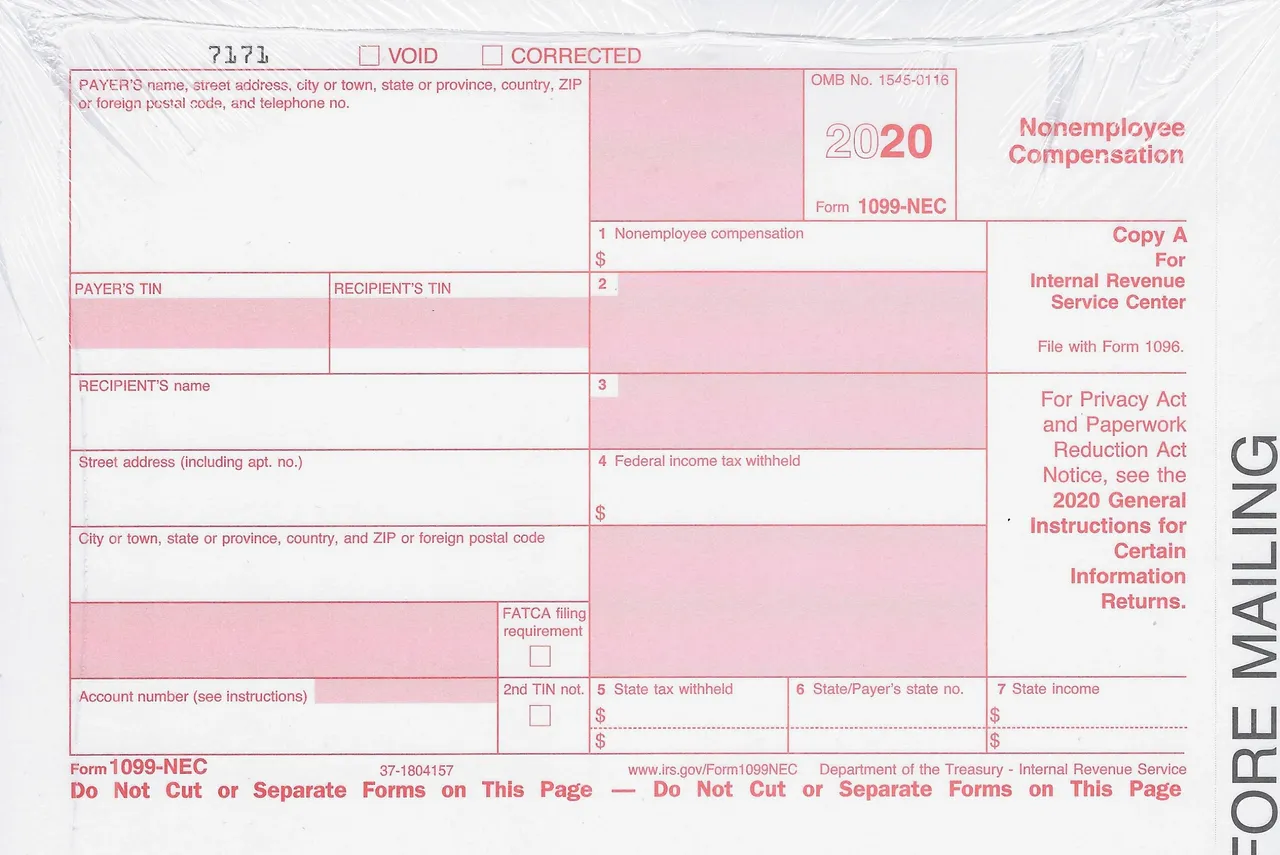

Background: Form 1099MISC Rules. Usually if business hires a subcontractor in their line of business and pays them $600 or more during the year, the contractor should be given Form 1099 MISC form to document payment for services. Exceptions exist, but that discussion is outside the scope of this article. If a 1099 Misc Form is filed with an inaccurate identification number (e .g. Social Security or Employer Identification number) the filer must promptly correct the error or be subject to backup withholding (28% tax rate).

Taxpayer filed his 1099 Misc forms to document the contractor payments deduction on his return, but omitted the contractor’s Social Security numbers on the 1099MISC forms. He did not correct the incomplete 1099 MISC forms or respond to IRS Notices.

The IRS billed Mr. Quezada $1.2 Million for backup withholding. He filed bankruptcy and took his case to the United States Tax Court. Tax Court ruled that since the IRS had tried to collect more than three years after the Forms 1099 and 1040 were filed, IRS could not collect on this debt.

MORAL: Mr. Quezada got a “lucky” break. IRS usually does NOT lose a case. If using subcontractors, file an accurate and complete 1099MISC. Require that your contractors complete Form W-9 before issuing payment. Address IRS Notices promptly.

If Mr. Quezada had NOT filed any 1099 MISC, the IRS could have fined him for NOT filing. Filing starts the time clock that limits IRS’s power to assess and collect. IRS has three years from the file date of the return to bill and ten years after the billing date (“Assessment date”) to collect. If the IRS misses those deadlines, they are barred by statute from billing or collecting for that tax year.

Non filers have no limits on IRS assessment and collection powers. So if the IRS had assessed for non filing of the 1099MISC, the Tax Court wouldn’t have been so generous. Mr. Quezada would have owed. . . Catch 22 see “MORAL” above. . .

Yes the pic is NOT a 1099MISC form. Starting with 2020 tax year, subcontractor payments are reported on FORM 1099 NEC (stands for Non Employee Compensation). All other 1099 MISC income categories are reported on the same form as last year–1099 MISC.